Governments lose millions as Okanagan homes sales fall

The Canadian Home Builders’ Associations of the Central Okanagan and the Federal CHBA in advance of the upcoming federal election have launched a public awareness campaign on Housing Affordability.

The CHBA has launched a new website aimed at voters concerned about homeownership. The site, www.affordability.ca, summaries factors impacting affordability and informs voters and media on the issues. As party platforms become available, policies that affect housing will be summarized and explained through the affordability lens. CHBA is planning a multi-faceted federal election campaign to drive traffic to the website to inform voters, candidates, and media about the issues.

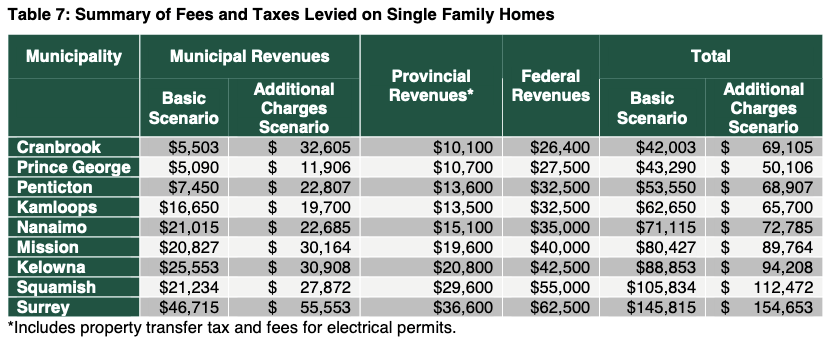

“Housing Affordability is an issue we hear about often and it’s a top concern of all Canadians,” says Cassidy deVeer, president, Canadian Home Builders Association Central Okanagan (CHBA-CO). “When buyers hear their homes include more than $94,000 in tax you get their attention quickly.”

A recent report, commissioned by the BC Chapter of the CHBA, completed in 2019 and not released publically until now, reveals that one new house built and sold in the Central Okanagan raises more than 94,000 in revenues split by three Governments. *

The report, “Estimating the Benefits to Government of New Home Construction” produced by charter accountancy and business advisory firm MNP, studied how the building of a new home is affected by development fees and charges in nine communities across BC. The report also details the tax revenue raised on the construction of a townhome and is available here.

The report looked at both fees and taxes directly levied on the construction and sale of new homes and additional revenues generated through income taxes and taxes on the construction materials. Additional revenues were income tax paid by those employed in building homes and Provincial sales taxes generated from the purchase of materials. This report did not take into account the current Energy Step Code charges.

deVeer continues, “When discussing housing affordability, its important people know how much of the cost of a home is tax. Obviously, Governments need revenue and we are certainly not advocating there shouldn’t be any tax but tackling housing affordability will require Government and Industry to work together.”

“There is a ripple effect when sales and new homes are postponed or cancelled. It’s not just the home builders but all those who service and supply the industry. A flooring supplier representative

told me yesterday that his residential sales are way down. Based on this report, we can see there is a direct impact on government revenues as well.”

The Okanagan Mainline Real Estate Board reported in July that year to date sales in the Central Okanagan for the period ending June 2019 there were 2357 homes sold compared to 2772 homes sold during the same period (Source).

Across the Province, The British Columbia Real Estate Association (BCREA) reported that a total of 6,960 residential unit sales were recorded in June, a decline of 11.8 per cent from the same month last year. The average MLS® residential price in the province was $687,584, a decline of 4 per cent from June 2018. Total sales dollar volume was $4.8 billion, a 15.3 per cent decline from the same month last year. (Source).

-30-

*Addendum on methodology used by MNP in its report (full details here)

Standard Archetypes: Development fees and charges are calculated based on the characteristics of the development. To ensure that differences in municipal revenues were not the result of differences in the characteristics of the development MNP used standard specifications or “archetypes” to estimate development fees and charges.

Scenarios: There are two categories of fees and charges levied by municipalities –those that are applicable to all developments and those that only apply in specific circumstances. To account for this MNP based its estimates on two scenarios. Basic Scenario: This scenario includes only the standard fees and charges applicable to all new home developments, and assumes that no rezoning, subdivision or site servicing is required. Additional Charges Scenario: This scenario includes both the standard fees and charges, and additional charges that are incurred when rezoning, subdivision and site servicing is required.

Estimated Government Revenues: Municipal government revenues were estimated based on the applicable published fees and charges for each municipality. Estimates of provincial sales taxes, provincial and federal income taxes and number of jobs created were developed using Statistics Canada’s BC 2013 input-output multipliers for residential building construction. A description of how provincial sales and income taxes were calculated is provided in Appendix B of the report. Estimates of property tax and property transfer tax were developed based on tax rates published by the Government of British Columbia. Estimates of GST were developed by applying 5 percent to the estimated sale price for each housing unit.

For more information about the Canadian Home Builders’ Association Central Okanagan, visit www.chbaco.com. Media Contact: Scott Henderson,t.250.317.3751, scott.henderson@dhzmedia.com

About the Canadian Home Builders’ Association Central Okanagan:

CHBA-CO is the regional voice of the residential construction industry in the Central Okanagan. It represents more than 250 members and is part of an affiliated network of nine local home building associations located throughout the province. The industry contributes over $25 billion in investment value to British Columbia’s economy creating 200,000 jobs in new home construction, renovation, and repair. One in five employees in British Columbia work in the home building industry.